In the intricate dance of modern business, few operations are as critical, or as sensitive, as payroll. It’s not merely about cutting checks; it’s about ensuring fair compensation, maintaining employee morale, complying with a labyrinth of regulations, and safeguarding your company’s financial integrity. Manual payroll processes, fraught with the risk of human error and time-consuming complexities, can quickly become a significant drain on resources and a source of unnecessary stress. This is precisely why the adoption of dedicated payroll software has become an indispensable tool for businesses of all sizes across the globe.

This blog post will delve into the transformative power of modern payroll software, exploring its core functionalities and the myriad benefits it offers. We will then specifically focus on the unique landscape of the United Arab Emirates, examining the crucial role of compliant payroll software UAE, and drill down further into the essential features of integrated HR and payroll software Dubai, where adherence to local labor laws and meticulous record-keeping are paramount for business success.

The Digital Backbone: Understanding Payroll Software

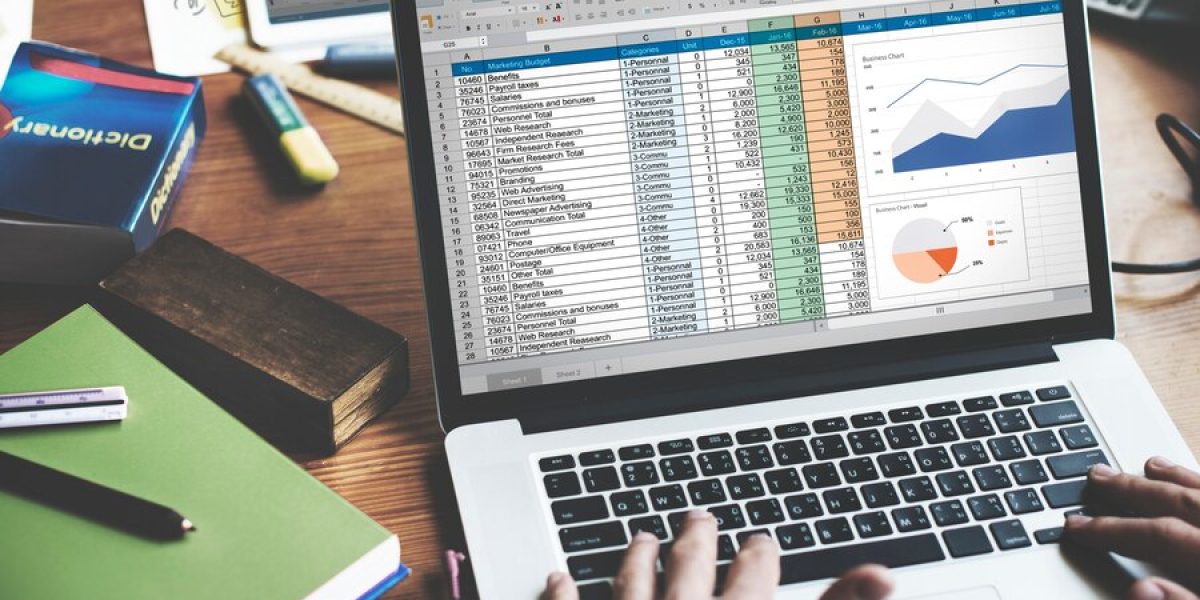

At its heart, payroll software is a specialized application designed to automate, streamline, and manage all aspects of employee compensation. From calculating wages and deductions to processing payments and generating statutory reports, it centralizes what would otherwise be a complex, fragmented, and error-prone manual process.

Why the Shift from Manual to Software?

For decades, payroll involved countless hours of manual data entry, calculation, and reconciliation. Businesses relied on spreadsheets, physical ledgers, and even paper time cards. This approach, while traditional, was riddled with inherent challenges:

- High Risk of Error: Even a single misplaced decimal or miscalculated hour could lead to incorrect pay, employee dissatisfaction, and significant financial repercussions.

- Time-Consuming: The sheer volume of calculations, data entry, and record-keeping consumed valuable administrative time.

- Compliance Headaches: Constantly changing tax laws, social security contributions, and labor regulations made it incredibly difficult to stay compliant manually.

- Lack of Transparency: Employees often had limited access to their pay details, leading to queries and administrative burden on HR.

- Security Risks: Storing sensitive employee and financial data in physical files or unsecured spreadsheets posed significant security and privacy risks.

The advent of payroll software directly addresses these challenges, offering a robust, secure, and efficient alternative.

Core Features and Capabilities of Modern Payroll Software:

While specific features may vary between providers and plans, a comprehensive payroll software typically includes:

- Automated Wage Calculation: This is the foundational feature. The software automatically calculates gross pay based on salaries, hourly rates, overtime, bonuses, commissions, and other earnings.

- Deduction Management: Accurately calculates and applies all necessary deductions, including:

- Taxes (e.g., income tax, social security, provident fund contributions – relevant depending on jurisdiction).

- Employee benefits (health insurance, retirement plans).

- Loan repayments, garnishments, and other pre- or post-tax deductions.

- Tax Compliance & Reporting: One of the most critical aspects. The software keeps up-to-date with changing tax laws and regulations, generates statutory tax forms (e.g., annual summaries, quarterly reports), and often facilitates direct e-filing with tax authorities.

- Direct Deposit & Payment Processing: Automates the payment process by directly depositing net salaries into employees’ bank accounts. Many systems also support other payment methods or printing physical checks.

- Payslip Generation: Automatically creates detailed, secure, and customizable payslips that can be distributed electronically (via email or employee portal) or printed.

- Employee Self-Service (ESS) Portal: A game-changer for employee empowerment. Employees can securely log in to view and download their payslips, tax documents, update personal information, view leave balances, and sometimes submit leave requests or expense claims.

- Time & Attendance Integration: Many payroll systems integrate directly with time tracking systems (e.g., biometric scanners, online clock-in/out tools) to automatically import employee hours, significantly reducing manual data entry and errors.

- Leave Management: Tracks various types of employee leave (annual leave, sick leave, maternity leave, unpaid leave), calculates leave balances, and processes leave-related pay.

- Expense Reimbursement: Streamlines the process of submitting, approving, and reimbursing employee expenses, often integrating these reimbursements directly into the payroll run.

- Reporting and Analytics: Generates a wide array of customizable reports, including payroll summaries, tax liability reports, employee cost analysis, historical payroll data, and benefits cost reports. These insights are invaluable for budgeting, forecasting, and strategic HR decisions.

- Benefits Administration Integration: Connects payroll data with employee benefits platforms, simplifying the management of health insurance, retirement plans, and other perks.

- Onboarding & Offboarding Support: Facilitates the smooth onboarding of new hires by collecting necessary payroll information and streamlines offboarding processes, including final settlements and gratuity calculations.

- Data Security & Privacy: Implements robust security measures, including encryption, access controls, and regular backups, to protect sensitive employee and financial data.

- Scalability: Designed to accommodate businesses as they grow, handling increasing numbers of employees, complex pay structures, and multiple locations.

By centralizing these functions, payroll software transforms a complex administrative burden into a strategic asset, ensuring accuracy, compliance, and employee satisfaction.

The UAE Context: Navigating Payroll Software UAE

The United Arab Emirates presents a unique and dynamic business environment, characterized by rapid growth, a diverse multinational workforce, and a sophisticated regulatory framework. For any business operating here, selecting and implementing robust payroll software UAE is not just about efficiency; it’s a critical compliance imperative.

Key Regulatory and Market Factors in the UAE:

- Wage Protection System (WPS) Compliance: This is arguably the most crucial payroll regulation in the UAE. Mandated by the Ministry of Human Resources and Emiratisation (MoHRE) and the Central Bank of the UAE, WPS requires all private sector companies to pay employee salaries via authorized banks or financial institutions within a specific timeframe (usually the 15th of the month). Non-compliance can lead to severe penalties, including fines and business operation restrictions. A compliant payroll software UAE must be capable of generating the necessary SIF (Salary Information File) format for WPS submission.

- End-of-Service Gratuity Calculation: The UAE Labour Law dictates specific rules for calculating end-of-service gratuity for employees who have completed at least one year of continuous service. The calculation depends on the employee’s length of service and basic salary. The payroll software UAE must accurately automate these complex calculations.

- Annual Leave & Other Leave Entitlements: The UAE Labour Law specifies entitlements for annual leave, sick leave, maternity leave, and other special leaves. The software must correctly track leave balances, calculate leave pay (including leave encashment upon termination), and ensure adherence to legal provisions.

- Social Security & Pension (for UAE & GCC Nationals): While there is no personal income tax for expatriates, UAE and GCC nationals employed in the private sector are subject to mandatory social security and pension contributions. The employer and employee each contribute a percentage of the gross salary. The payroll software UAE must be able to accurately calculate and manage these contributions.

- VAT and Corporate Tax Considerations: Although payroll itself isn’t directly subject to VAT, payroll expenses form part of a company’s overall financial records. Similarly, the recent introduction of Corporate Tax (effective June 1, 2023, for financial years starting on or after this date) means that payroll costs will be part of the deductible expenses. The software should integrate well with accounting systems to provide accurate financial reporting for tax purposes.

- Multi-Currency Handling: Given the multinational workforce and international nature of many businesses in the UAE, the ability to handle transactions in multiple currencies (e.g., USD, EUR, GBP, alongside AED) is a significant advantage.

- Customizable Salary Structures: UAE businesses often have diverse salary components, including basic salary, housing allowances, transport allowances, and other benefits. The software should be flexible enough to configure these varied components.

- Arabic Language Support: While English is widely used, having Arabic language options for payslips, employee portals, and reports can enhance user experience and ensure clarity for all employees.

- Data Security and Privacy: Protecting sensitive employee and financial data is paramount. Businesses should look for payroll software UAE solutions that offer robust security features, comply with data protection best practices, and ideally, have data centers within the UAE or a region that aligns with their data residency requirements.

Benefits of Compliant Payroll Software in UAE:

- Avoid Penalties: Ensures strict adherence to WPS, gratuity, and leave laws, mitigating the risk of costly fines and legal repercussions.

- Efficiency: Automates calculations and processes specific to UAE labor laws, saving significant administrative time.

- Accuracy: Reduces human error in complex calculations like gratuity and social security.

- Transparency: Provides clear payslips and employee portals for staff, reducing payroll-related queries.

- Audit Readiness: Maintains comprehensive, digital records that are easily accessible for internal audits or government inspections.

- Scalability: Supports business growth by handling increasing employee numbers and evolving payroll complexities seamlessly.

Choosing the right payroll software UAE is a strategic decision that directly impacts a business’s compliance, efficiency, and reputation in this unique and highly regulated market.

Integrated Solutions: HR and Payroll Software Dubai

Dubai, as a global business and tourism hub, operates under the comprehensive UAE Labour Law but often has its own specific interpretations and heightened enforcement. The dynamic nature of its workforce, coupled with stringent regulations, makes integrated HR and payroll software Dubai an essential strategic asset for businesses of all sizes.

Why Integration is Key in Dubai:

Traditionally, HR functions (recruitment, onboarding, performance, leave management) and payroll were handled by separate systems, often leading to data discrepancies, duplicated efforts, and communication silos. An integrated HR and payroll software Dubai solution brings these critical functions together, creating a unified system that offers immense benefits:

- Seamless Data Flow: Employee data (new hires, salary changes, promotions, terminations, leave data) flows automatically between HR and payroll modules. This eliminates manual data entry errors and ensures that payroll calculations are always based on the most up-to-date HR information.

- Enhanced Compliance with Dubai Labor Law: Dubai enforces the UAE Labour Law rigorously. An integrated system helps ensure compliance with:

- WPS (Wage Protection System): As discussed, critical for timely salary payments. The HR module tracks employee bank details, which feed directly into the payroll module for WPS file generation.

- End-of-Service Benefits (Gratuity): HR maintains records of service periods and basic salaries, which the payroll module uses for accurate gratuity calculation upon termination.

- Leave Management: The HR module manages leave requests, approvals, and balances, and this data is seamlessly integrated with payroll for correct leave encashment or deduction.

- Working Hours & Overtime: Time and attendance data captured in the HR module directly informs overtime calculations in payroll.

- Minimum Wage & Salary Structure: While there isn’t a universal minimum wage for all, specific minimum wages for UAE nationals exist. The integrated system helps manage and verify salary structures against these requirements.

- Improved Efficiency and Productivity: Automating data transfer between HR and payroll reduces administrative burden significantly. HR teams spend less time on manual payroll inputs, and payroll teams spend less time chasing HR for information. This frees up both departments to focus on more strategic initiatives.

- Centralized Employee Records: All employee information – from personal details, contract terms, performance reviews, training records, leave history, to salary and payment history – resides in one comprehensive database. This provides a holistic view of each employee and simplifies reporting.

- Better Employee Experience: An integrated system, especially with a robust Employee Self-Service (ESS) portal, empowers employees. In Dubai’s competitive talent market, providing employees easy access to their payslips, leave balances, and personal information, and enabling them to apply for leave or update details online, significantly boosts satisfaction and transparency.

- Strategic HR Insights: With integrated data, HR teams can generate powerful analytics linking payroll costs to recruitment, retention, performance, and overall workforce planning. This helps in making data-driven decisions about compensation strategies, talent management, and organizational development.

- Robust Security and Auditability: Consolidating data in a secure, integrated system with role-based access controls enhances data security. For businesses in Dubai, having a clear audit trail of all HR and payroll transactions is vital for internal governance and external regulatory checks.

Key Features to Prioritize for HR and Payroll Software Dubai:

- WPS File Generation: Non-negotiable for compliance.

- Gratuity & Leave Accrual/Calculation: Accurate and automated calculation as per UAE Labour Law.

- Configurable Pay Elements: Flexibility to define and manage various allowances and deductions common in the UAE.

- Employee Self-Service Portal: Comprehensive and user-friendly for payslips, leave, and personal data updates.

- Time & Attendance Integration: Seamless connection with attendance systems.

- Arabic Language Interface (Optional but beneficial): For better adoption among diverse staff.

- Reporting for Local Regulations: Ability to generate reports for social security contributions, visa status tracking (if combined with visa management module), etc.

- Robust Security & Data Privacy: Especially important given the sensitive nature of HR and payroll data.

- Scalability: To accommodate growth in employee numbers and complexity.

Leading providers of HR and payroll software Dubai often offer integrated suites, acknowledging the inextricable link between human resources and financial compensation in managing a thriving workforce. Solutions from global players like SAP SuccessFactors, Oracle HCM, and local specialists like Bayzat, Zoho People, Gulf HR, and Paylite are popular choices, offering varying degrees of integration and localization. Choosing the right integrated solution is a strategic investment that underpins operational efficiency, legal compliance, and employee satisfaction in Dubai’s dynamic business environment.

The Unignorable Benefits of Payroll Software

The transition from manual payroll processing to a sophisticated payroll software solution offers a multitude of benefits that directly impact a business’s operational efficiency, financial health, employee satisfaction, and legal standing. These advantages are universal, applying to businesses across industries and geographies, including the complex regulatory landscape of the UAE.

-

Unparalleled Accuracy and Error Reduction: This is perhaps the most significant benefit. Manual calculations and data entry are inherently prone to human error, which can lead to overpayments, underpayments, incorrect tax deductions, and disgruntled employees. Payroll software automates these calculations, minimizing mistakes, ensuring precise deductions, and guaranteeing that employees are paid the correct amount on time, every time. This accuracy also extends to statutory filings, reducing the risk of penalties.

-

Significant Time and Cost Savings: Automating payroll processes dramatically reduces the administrative time spent by HR and finance teams. Tasks such as calculating wages, managing deductions, generating payslips, and preparing tax forms that once took hours, or even days, can now be completed in minutes. This frees up valuable staff time to focus on more strategic, value-added activities, effectively reducing labor costs associated with payroll administration.

-

Ensured Regulatory Compliance: Navigating ever-changing tax laws, labor regulations, and social security contributions is a complex and risky endeavor. Reputable payroll software providers regularly update their systems to reflect the latest legal requirements (e.g., UAE’s WPS, gratuity, and Corporate Tax laws). This built-in compliance mechanism helps businesses avoid costly fines, legal disputes, and reputational damage due to non-adherence.

-

Enhanced Data Security and Confidentiality: Payroll data is highly sensitive, containing personal employee information, banking details, and salary figures. Modern payroll software employs robust security measures, including data encryption, secure cloud storage, multi-factor authentication, and role-based access controls. This safeguards confidential information from unauthorized access, cyber threats, and data loss, ensuring compliance with data protection regulations.

-

Improved Employee Satisfaction and Transparency: Employees expect to be paid accurately and on time. Payroll software delivers this reliability, fostering trust and boosting morale. Features like Employee Self-Service (ESS) portals further enhance satisfaction by providing employees with convenient, 24/7 access to their payslips, tax documents, leave balances, and personal information, reducing the need to contact HR for routine inquiries.

-

Streamlined Reporting and Analytics: The software generates a wealth of detailed reports instantly. These reports offer critical insights into labor costs, overtime expenses, tax liabilities, and employee benefits. This data-driven visibility empowers management to make informed decisions regarding budgeting, forecasting, workforce planning, and optimizing compensation strategies.

-

Seamless Integration with Other Systems: Many payroll software solutions seamlessly integrate with other crucial business systems, such as HR management (HRMS), accounting software, time and attendance tracking, and even ERP systems. This integration creates a unified data flow, eliminates duplicate data entry, and provides a holistic view of your business operations. For example, in HR and payroll software Dubai, the integration ensures that leave taken in HR automatically impacts payroll calculations.

-

Scalability to Support Business Growth: As a business expands, its payroll complexities naturally increase. A well-chosen payroll software is designed to scale with your organization, effortlessly accommodating new hires, multiple pay schedules, different departmental structures, and even international expansion without requiring a complete system overhaul.

-

Reduced Audit Risks: With meticulous record-keeping and an automated audit trail for every transaction, payroll software makes preparing for and undergoing audits significantly less stressful. All necessary documentation is readily available, proving compliance and reducing the likelihood of discrepancies.

In essence, investing in payroll software is a strategic move that transforms an administrative necessity into a powerful driver of efficiency, compliance, and employee satisfaction, ultimately contributing to the overall success and resilience of your business.

Challenges and Best Practices for Implementation

While the benefits of payroll software are compelling, successful implementation and ongoing management require careful planning and adherence to best practices. Ignoring potential challenges can lead to frustration, errors, and a failure to realize the full benefits of the system.

Common Challenges in Implementing Payroll Software:

- Data Migration Complexity: Transferring existing employee data, historical payroll records, and year-to-date figures from old systems or spreadsheets can be a time-consuming and error-prone process.

- Compliance Interpretation: Ensuring the software is correctly configured to meet specific local regulations (e.g., WPS, gratuity, social security in the UAE) requires a deep understanding of these laws.

- Integration Issues: Connecting the payroll software with other essential systems like HRMS, accounting software, or time & attendance systems can be technically challenging if APIs are not robust or if systems are incompatible.

- User Adoption and Training: Employees and HR/finance staff may resist adopting a new system, especially if they are accustomed to traditional methods. Insufficient training can lead to underutilization of features and user frustration.

- Customization Needs: While off-the-shelf solutions are powerful, some businesses have unique payroll policies or complex compensation structures that require significant customization, which can increase costs and implementation time.

- Data Security Concerns: Migrating sensitive payroll data to a new system, especially cloud-based, raises concerns about data privacy and security, requiring diligent vetting of the vendor’s security protocols.

- Cost and ROI Justification: The initial investment (setup fees, training, subscription) can be substantial, and justifying the return on investment (ROI) can be difficult if benefits are not clearly articulated and tracked.

Best Practices for Successful Implementation and Optimization:

-

Thorough Needs Analysis & Vendor Selection:

- Define Requirements: Clearly outline your specific payroll needs, considering factors like employee count, pay frequency, complexity of deductions/benefits, and integration requirements. For payroll software UAE or HR and payroll software Dubai, explicitly list compliance needs (WPS, gratuity, social security, CT/VAT reporting integration).

- Research & Compare: Evaluate multiple vendors. Look at their features, pricing models, customer support, and, crucially, their expertise in your specific region (e.g., UAE labor laws).

- Request Demos & Trials: See the software in action with realistic scenarios. Utilize free trials to test basic functions with your own data.

-

Meticulous Data Preparation and Migration:

- Clean Data: Before migration, clean and validate your existing payroll data. Remove duplicates, correct inconsistencies, and ensure all employee records are accurate and complete.

- Phased Migration (if applicable): For large organizations, consider migrating data in phases or running parallel payrolls (old and new system) for a few cycles to ensure accuracy before fully switching.

- Verify Post-Migration: After data transfer, conduct rigorous verification checks. Reconcile historical data and run mock payrolls to confirm accuracy.

-

Comprehensive Training and Change Management:

- Role-Based Training: Provide targeted training for different user groups (HR, finance, employees using ESS).

- Ongoing Support: Offer continuous support, including clear documentation, FAQs, and a dedicated point of contact for troubleshooting.

- Communicate Benefits: Clearly articulate to employees and staff how the new system will benefit them (e.g., easier access to payslips, faster reimbursements).

-

Configure for Local Compliance (Especially in UAE/Dubai):

- WPS & Gratuity Settings: Ensure the software’s parameters for WPS file generation and gratuity calculations are correctly configured according to the latest UAE Labour Law.

- Social Security: Set up accurate deductions for UAE/GCC nationals.

- Tax Updates: Verify that the system automatically updates for any changes in VAT or Corporate Tax implications related to payroll expenses.

- Regular Updates: Stay informed about changes in local regulations and ensure your software provider issues timely updates.

-

Leverage Employee Self-Service (ESS):

- Promote Adoption: Encourage employees to use the ESS portal for common tasks like viewing payslips and updating personal details. This significantly reduces the administrative load on HR.

-

Integrate with Other Systems:

- Seamless Workflow: Integrate your payroll software with HR management, time & attendance, and accounting systems. This creates a unified data flow, eliminates manual double-entry, and enhances overall data accuracy.

- API Capabilities: Check if the software offers robust APIs for custom integrations if needed.

-

Regular Audits and Reporting:

- Internal Audits: Conduct periodic internal audits of payroll data to catch any discrepancies early.

- Utilize Reports: Regularly generate and analyze payroll reports to monitor costs, identify trends, and support strategic decision-making.

By meticulously planning and executing the implementation and by embracing these best practices, businesses can unlock the full potential of their payroll software, transforming a complex administrative function into a strategic advantage that drives efficiency, ensures compliance, and fosters a satisfied workforce.

Conclusion: The Future of Workforce Compensation is Automated

In today’s dynamic global economy, the efficient and accurate management of employee compensation is more than just a procedural task; it’s a cornerstone of operational excellence, employee satisfaction, and regulatory compliance. The days of relying on manual calculations and fragmented spreadsheets for payroll are rapidly fading, replaced by the indispensable power of advanced payroll software. This technological shift transforms a potentially burdensome administrative function into a strategic advantage, enabling businesses to streamline operations, minimize errors, and gain unparalleled financial clarity.

For businesses operating in the vibrant and highly regulated market of the UAE, and particularly in a key hub like Dubai, the adoption of specialized payroll software UAE or integrated HR and payroll software Dubai is not merely a choice but a critical imperative. The unique mandates of the Wage Protection System (WPS), complex gratuity calculations, diverse social security contributions, and evolving tax regulations demand a solution that is meticulously designed for local compliance. The right software ensures legal adherence, mitigates financial risks, and empowers HR and finance teams to operate with confidence and precision.

Ultimately, investing in a robust payroll system is an investment in your people and your profitability. It fosters trust by ensuring timely and accurate payments, enhances efficiency by automating repetitive tasks, and provides the strategic insights necessary for informed decision-making. As businesses continue to evolve, the intelligent application of payroll technology will remain a key differentiator, enabling organizations to manage their most valuable asset – their workforce – with unparalleled effectiveness and foresight. Embrace the future of payroll, and empower your business for sustainable success.

5 FAQs About Payroll Software

-

What is the Wage Protection System (WPS) in the UAE, and how does payroll software help with it? The Wage Protection System (WPS) is a mandatory electronic salary transfer system in the UAE, requiring all private sector companies to pay employees through authorized financial institutions. Payroll software UAE is crucial for WPS compliance as it automatically generates the required SIF (Salary Information File) in the correct format, which can then be submitted to your bank for salary disbursements. This ensures timely and compliant payment, helping businesses avoid penalties.

-

Can payroll software calculate end-of-service gratuity and leave encashment? Yes, a key feature of good payroll software, especially those tailored for the UAE market, is the ability to accurately calculate end-of-service gratuity and leave encashment. These calculations are often complex, depending on factors like length of service, basic salary, and specific leave entitlements as per the UAE Labour Law. The software automates these calculations, ensuring compliance and accuracy when an employee leaves the company.

-

How secure is my employee and payroll data with cloud-based payroll software? Reputable cloud-based payroll software providers invest heavily in security measures to protect your sensitive data. This typically includes advanced data encryption (both in transit and at rest), multi-factor authentication (MFA), regular security audits, redundant data backups, and disaster recovery plans. They often comply with global data protection standards (e.g., ISO 27001). However, it’s always advisable to research a vendor’s security protocols thoroughly and ensure they meet your company’s data privacy requirements.

-

Does payroll software integrate with other HR or accounting systems? Yes, many modern payroll software solutions are designed to integrate seamlessly with other business systems. Common integrations include:

- HR Management Systems (HRMS): To synchronize employee data, leave information, and onboarding details.

- Accounting Software: To automatically post payroll expenses to the general ledger, simplifying financial reporting and reconciliation.

- Time & Attendance Systems: To import employee work hours directly, reducing manual data entry and improving accuracy. This integration creates a unified ecosystem, eliminates data silos, and enhances overall operational efficiency.

-

Is payroll software only for large companies, or can small businesses benefit too? Payroll software is highly beneficial for businesses of all sizes, including small businesses. While larger enterprises may require more complex features like multi-country payroll or advanced analytics, numerous affordable and user-friendly solutions cater specifically to small businesses. Even with just a few employees, the time savings, error reduction, and compliance benefits offered by payroll software can significantly outweigh its cost, freeing up valuable time for business owners to focus on growth.