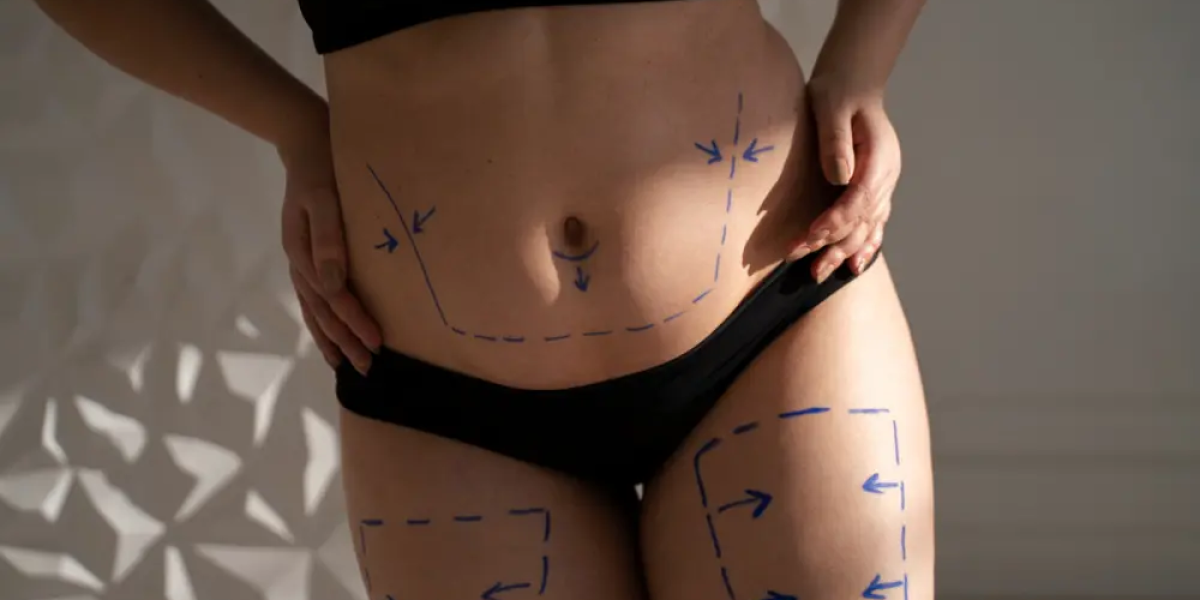

If you’re considering liposuction as a way to contour your body, one of the first questions that may arise is, is liposuction covered by insurance? In most cases, liposuction is considered a cosmetic procedure, meaning it is not typically covered by health insurance plans. However, there are exceptions depending on the circumstances, and it’s essential to understand the factors that may influence insurance coverage for Liposuction surgery(جراحة شفط الدهون).

Cosmetic vs. Medically Necessary Liposuction:

The distinction between cosmetic and medically necessary liposuction is crucial when it comes to insurance coverage. Here’s a breakdown of the difference:

-

Cosmetic liposuction: Liposuction done purely for aesthetic reasons, such as removing stubborn fat for body contouring, is typically classified as a cosmetic procedure. In these cases, insurance will usually not cover the costs.

-

Medically necessary liposuction: If liposuction is performed to treat a medical condition, such as lipedema (a condition that causes an abnormal buildup of fat in the legs), insurance might provide coverage. However, medical necessity must be clearly documented by your healthcare provider.

When Liposuction May Be Covered by Insurance?

In some situations, liposuction can be deemed medically necessary, which may lead to partial or full insurance coverage. Here are a few scenarios where insurance might cover liposuction:

-

Lipedema treatment: If you have lipedema, which is often mistaken for general obesity, liposuction can help reduce the abnormal fat buildup and alleviate pain and discomfort. Insurance may cover the procedure in such cases.

-

Post-traumatic liposuction: If liposuction is used to remove fat after trauma, such as after a car accident or other injuries, insurance may cover the costs if it’s deemed necessary for your health and recovery.

-

Reconstructive surgery after massive weight loss: If you have undergone significant weight loss (e.g., through bariatric surgery) and have excess fat that causes health problems, liposuction may be considered as part of a reconstructive surgery plan. Insurance might cover it in these cases if you can prove the medical necessity.

What to Do If You Think Liposuction Is Medically Necessary?

If you believe your liposuction procedure may be covered by insurance due to medical reasons, you need to take certain steps to increase your chances of approval:

-

Consult with your doctor: Speak with your healthcare provider to discuss your condition and how liposuction could help. They can provide necessary documentation to support your claim.

-

Get a letter of medical necessity: If your doctor agrees that liposuction is medically necessary, they will provide a letter explaining the need for the procedure and its potential health benefits.

-

Check with your insurance company: Before scheduling your procedure, contact your insurance provider to understand their specific requirements and whether they will cover liposuction. They may require specific forms or documentation from your healthcare provider.

Costs of Liposuction Without Insurance Coverage:

Since liposuction is typically considered a cosmetic procedure, you will likely need to pay for the surgery out-of-pocket if it is not covered by insurance. Here are some factors that influence the cost of liposuction:

-

Location of the surgery: The cost of liposuction can vary depending on where you live, with larger cities generally having higher prices.

-

Area(s) treated: The more areas you have treated, the higher the cost. Treating multiple areas or larger areas can increase the cost significantly.

-

Surgeon’s expertise: Experienced and board-certified plastic surgeons may charge higher fees for their services.

-

Additional expenses: In addition to the surgeon’s fee, there may be costs for anesthesia, facility fees, post-operative garments, and medications.

It’s important to get a detailed breakdown of costs before undergoing liposuction to avoid unexpected expenses.

Financing Options for Liposuction:

If Best Liposuction surgery(أفضل جراحة شفط الدهون) isn’t covered by insurance, many patients choose to finance the procedure. Fortunately, there are various financing options available to help make the procedure more affordable:

-

Personal loans: You may be able to take out a personal loan to cover the cost of liposuction. Many financial institutions offer loans specifically for medical procedures.

-

Credit cards: Some people choose to use credit cards with 0% APR for a promotional period to pay for liposuction. However, it’s important to manage credit wisely to avoid interest charges.

-

Payment plans: Many plastic surgery centers offer in-house financing or installment payment plans, which can allow you to pay for liposuction over time.

-

Medical credit cards: Specialized medical credit cards, such as CareCredit, can be used to finance cosmetic procedures like liposuction, often with deferred interest or low-interest rates.

Final Thoughts on Liposuction and Insurance Coverage:

To summarize, is liposuction covered by insurance? The answer depends on whether the procedure is considered cosmetic or medically necessary. While most liposuction procedures for cosmetic reasons are not covered by insurance, there are certain medical conditions, like lipedema or post-trauma, that may make the procedure eligible for insurance coverage. Always consult with your doctor and insurance provider to determine whether your procedure may be covered. If not, there are financing options available to help manage the cost of the procedure.