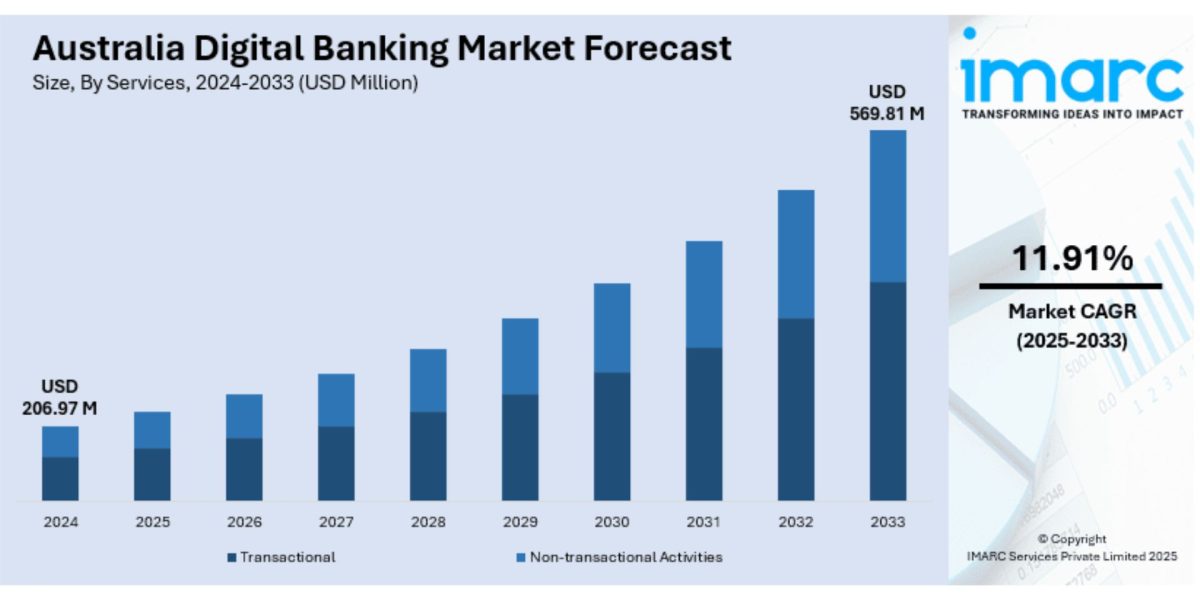

The latest report by IMARC Group, titled “Australia Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industry, and Region, 2025-2033,” offers a comprehensive analysis of the digital banking sector’s growth in Australia. The report features competitor and regional analysis, as well as segmentation by services, deployment type, technology, and industry. The Australia digital banking market size reached USD 206.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 569.81 Million by 2033, exhibiting a CAGR of 11.91% during 2025–2033.

Report Attributes:

-

Base Year: 2024

-

Forecast Years: 2025–2033

-

Historical Years: 2019–2024

-

Market Size in 2024: USD 206.97 Million

-

Market Forecast in 2033: USD 569.81 Million

-

Market Growth Rate 2025–2033: 11.91%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-digital-banking-market/requestsample

Australia Digital Banking Market Overview

-

The market is experiencing rapid digital transformation, with banks enhancing user experience through new digital platforms.

-

Mobile accessibility and intuitive interfaces are being prioritized to meet rising user expectations.

-

Artificial intelligence (AI) and machine learning (ML) are being integrated to deliver personalized and efficient banking services.

-

Regulatory frameworks such as open banking and the Consumer Data Right (CDR) are facilitating data sharing, innovation, and competition.

-

Enhanced security measures—including biometrics and two-factor authentication—are being implemented to foster consumer trust.

-

Financial institutions are shifting from branch-centric to digital-first models, aligning with changing customer behaviors.

-

Collaboration between banks and fintech firms is driving continuous product innovation and expanding the digital ecosystem.

Key Features and Trends of Australia Digital Banking Market

-

Digital banking applications are adding advanced features such as virtual cards, 24/7 support, and smart money management tools.

-

Banks are leveraging data analytics for real-time customer insights and tailored product offerings.

-

The industry is witnessing rising adoption of cloud-based deployment and embedded finance solutions.

-

QR-code and NFC-based payment methods are becoming mainstream, supporting seamless, contactless transactions.

-

Neobanks and digital-only banks are gaining market share with streamlined, user-centric offerings.

-

Sustainable digital banking practices and eco-friendly initiatives are being promoted to align with consumer values.

-

Open banking partnerships are enabling integrated services and expanding user choice.

Growth Drivers of Australia Digital Banking Market

-

Increasing smartphone and internet penetration across Australia.

-

Consumer demand for convenience, real-time transactions, and transparency.

-

Supportive regulatory initiatives like open banking and streamlined licensing.

-

Accelerated digital adoption post-COVID-19 and changing consumer preferences.

-

Technological innovations in AI, ML, blockchain, and cybersecurity.

Innovation & Market Demand of Australia Digital Banking Market

-

Financial institutions are developing AI-driven chatbots, virtual financial advisors, and advanced analytics tools.

-

Cross-platform and omnichannel banking experiences are being implemented for greater accessibility.

-

Digital wallet and contactless payment integrations are expanding as cashless trends accelerate.

-

Enhanced security protocols, such as biometric verification and dynamic PINs, are building market confidence.

-

Bank-fintech collaborations are resulting in faster product launches and greater service diversity.

Australia Digital Banking Market Opportunities

-

Expansion into underserved regions through digital platforms and mobile solutions.

-

Growth in personalized banking services leveraging consumer data analytics.

-

Rising demand for business digital banking tools among SMEs and corporates.

-

Open banking APIs creating new revenue streams and partnerships.

-

Increasing interest in value-added digital services, including wealth management and financial planning apps.

Australia Digital Banking Market Challenges

-

Managing regulatory compliance with data protection and privacy laws.

-

Cybersecurity threats and the growing sophistication of financial fraud.

-

High initial investment requirements for digital transformation.

-

Intense competition from established banks, neobanks, and global fintech entrants.

-

Managing digital inclusion for older and rural populations less familiar with technology.

Australia Digital Banking Market Analysis

-

Real-time transaction processing and 24/7 banking are becoming industry benchmarks.

-

Cloud adoption is enabling scalability and operational efficiency for banks.

-

Data-driven decision-making is being used for risk analytics and credit evaluation.

-

Continuous updates to user interfaces and mobile apps are keeping consumers engaged.

-

Market consolidation and strategic M&A activities are reshaping the competitive landscape.

Australia Digital Banking Market Segmentation

-

By Services:

-

Transactional (fund transfers, loans, deposits, payments)

-

Non-transactional (financial planning, risk management, information security)

-

-

By Deployment Type:

-

On-Premises

-

Cloud

-

-

By Technology:

-

Internet Banking

-

Digital Payments

-

Mobile Banking

-

-

By Industry:

-

Media and Entertainment

-

Manufacturing

-

Retail

-

Banking

-

Healthcare

-

-

By Region:

-

Australia Capital Territory & New South Wales

-

Victoria & Tasmania

-

Queensland

-

Northern Territory & Southern Australia

-

Western Australia

-

Australia Digital Banking Market News & Recent Developments

-

In 2025, Bankwest launched its revamped digital banking app and website, introducing virtual cards and property management tools as part of its national digital growth strategy.

-

Commonwealth Bank, in collaboration with AWS, introduced CommBiz Gen AI—a generative AI messaging application for business clients—aimed at optimizing payments and transactions.

Australia Digital Banking Market Key Players

-

Commonwealth Bank of Australia

-

Australia and New Zealand Banking Group (ANZ)

-

National Australia Bank (NAB)

-

Westpac Banking Corporation

-

Bankwest

-

Neobank providers (such as Up and Volt)

-

Global fintech firms and digital wallet providers

Key Highlights of the Report

-

Market Performance (2019–2024)

-

Market Outlook (2025–2033)

-

COVID-19 Impact on the Market

-

Porter’s Five Forces Analysis

-

Strategic Recommendations

-

Historical, Current, and Future Market Trends

-

Market Drivers and Success Factors

-

SWOT Analysis

-

Structure of the Market

-

Value Chain Analysis

-

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific insights not covered in the report, customization is available.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=35387&flag=E

FAQs: Australia Digital Banking Market

Q1: What is the projected size of the Australia digital banking market by 2033?

A: The market is expected to reach USD 569.81 Million by 2033.

Q2: Which factors are driving digital banking growth in Australia?

A: Key drivers include digital transformation, smartphone penetration, open banking regulation, tech innovation, and changing consumer preferences.

Q3: What are the major service segments in this market?

A: Transactional services (transfers, loans, payments) and non-transactional services (advice, planning, risk management).

Q4: Who are the prominent players in the Australian digital banking sector?

A: Commonwealth Bank, ANZ, NAB, Westpac, Bankwest, neobanks, and global fintechs.

Q5: Can the report be tailored for specific requirements?

A: Yes, IMARC offers customization and dedicated analyst support as needed.

About Us

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302