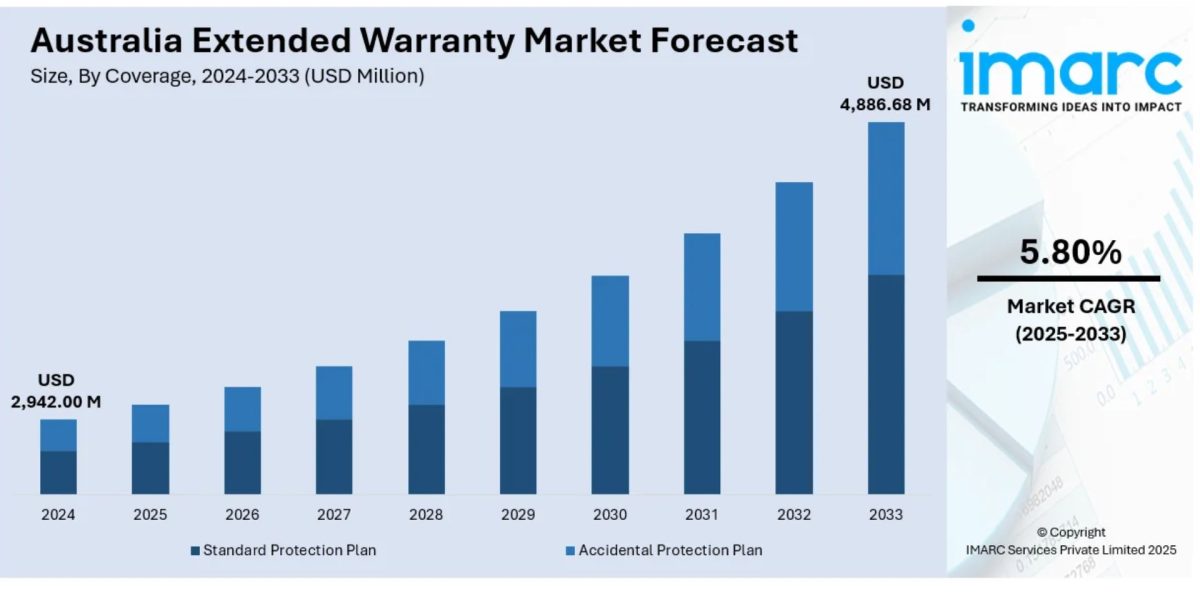

The latest report by IMARC Group, titled “Australia Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2025-2033,” offers a comprehensive analysis of the Australia extended warranty market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia extended warranty market size reached USD 2,942.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,886.68 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025–2033.

Report Attributes:

· Base Year: 2024

· Forecast Years: 2025–2033

· Historical Years: 2019–2024

· Market Size in 2024: USD 2,942.00 Million

· Market Forecast in 2033: USD 4,886.68 Million

· Market Growth Rate 2025–2033: 5.80%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-extended-warranty-market/requestsample

Australia Extended Warranty Market Overview

- The market is growing due to rising consumer demand for long-term vehicle protection and increased competition among automakers.

- Extended warranties are becoming key decision drivers, particularly for electric vehicles (EVs) due to concerns over new technology reliability.

- Automakers are expanding warranty packages, including 10-year coverage, to build consumer confidence and differentiate products.

- Growth in electric vehicle adoption is fueling demand for extended warranty services across Australia.

- The sector is adapting through more comprehensive, bumper-to-bumper warranty plans responding to customer expectations.

Key Features and Trends of Australia Extended Warranty Market

- Major players are enhancing warranty coverage durations for EV batteries and components to meet customer trust demands.

- Warranty offerings are evolving to include both standard protection and accidental protection plans.

- Manufacturers and retailers are structuring extended warranty distribution to optimize reach and service quality.

- Increasing collaborations between automakers and warranty providers are shaping competitive dynamics.

- Consumer inclination towards comprehensive coverage is driving the extension of warranty terms and services.

Growth Drivers of Australia Extended Warranty Market

- Rising consumer concerns about long-term vehicle reliability, especially EVs.

- Expanding product offerings by automakers to include longer and more comprehensive warranty packages.

- Growing competition in the automobile sector requiring differentiated value-added services.

- Increased sales volumes of electric and conventional vehicles with demand for post-purchase protection.

- Regulatory and market pressures encouraging warranties as consumer confidence enhancers.

Innovation & Market Demand of Australia Extended Warranty Market

- Warranty providers are incorporating technology to streamline claims processing and enhance customer experience.

- New EV models entering the market are accompanied by innovative warranty packages targeting long-term component durability.

- Enhanced warranty contracts are responding to evolving customer demands for transparency and coverage scope.

- Partnerships between car manufacturers and warranty providers are increasing to expand coverage options.

- Market demand is rising for extended service contracts across automobiles, consumer electronics, and home appliances.

Australia Extended Warranty Market Opportunities

- Increasing electric vehicle adoption providing a growing customer base for extended warranty products.

- Expansion into consumer electronics and mobile device warranty segments alongside automobile coverage.

- Use of digital platforms for warranty registration, claims, and customer engagement boosting market reach.

- Growing awareness of warranty benefits among business clients and individuals encouraging service uptake.

- Innovation in customizable warranty plans catering to specific consumer needs offering new revenue streams.

Australia Extended Warranty Market Challenges

- Managing warranty costs while maintaining profitability amid rising claim incidences.

- Complexities in assessing and validating warranty claims increasing operational overheads.

- Potential regulatory changes affecting warranty contract terms and consumer rights.

- Competition from alternative protection plans and insurance products.

- Educating consumers about the benefits and limitations of extended warranties to drive adoption.

Australia Extended Warranty Market Analysis

- Coverage segmentation includes standard protection plans and accidental protection plans balancing risk and customer needs.

- Applications cover automobiles, consumer electronics, home appliances, mobile devices & PCs, and others with automotive dominance.

- Distribution channels involve manufacturers, retailers, and other intermediaries optimizing market penetration.

- End users include individual consumers and business clients tapping different usage patterns.

- Regional presence covers major Australian territories including New South Wales, Victoria, Queensland, and Western Australia.

Australia Extended Warranty Market Segmentation:

By Coverage:

- Standard Protection Plan

- Accidental Protection Plan

By Application:

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices & PCs

- Others

By Distribution Channel:

- Manufacturers

- Retailers

- Others

By End User:

- Individuals

- Business

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Extended Warranty Market News & Recent Developments:

- In February 2025, Xpeng reintroduced a 10-year extended warranty for its G6 electric SUV, enhancing consumer confidence in EV reliability amid increasing competition.

- In April 2025, BYD expanded its warranty offerings in Australia with a six-year/150,000 km bumper-to-bumper warranty and an eight-year/160,000 km battery warranty, addressing growing market demand.

Australia Extended Warranty Market Key Players:

- Xpeng

- BYD

- Major automotive manufacturers offering extended warranty packages

- Retailers and warranty service providers specializing in consumer electronics and appliances

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=34992&flag=E

FAQs: Australia Extended Warranty Market

Q1: What was the size of the Australia extended warranty market in 2024?

A: The market size was USD 2,942.00 Million in 2024.

Q2: What growth rate is expected between 2025 and 2033?

A: The market is expected to grow at a CAGR of 5.80% during 2025-2033.

Q3: Which applications dominate the Australia extended warranty market?

A: Automobiles are the dominant application segment, followed by consumer electronics and home appliances.

Q4: What types of coverage are provided in this market?

A: Standard protection plans and accidental protection plans are the main coverage types.

Q5: Who are the key users of extended warranties in Australia?

A: Both individual consumers and businesses constitute the key end users of extended warranties.

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302